Trading AUD NZD Buy AUD NZD Sell AUD NZD IFCM India

Contents:

This means that stock trading may be particularly appealing to traders with long-term trading strategies. When it comes to ailments like influenza, malaria, and HIV AIDs, developed countries, have created better response strategies and lowered their infection rates. These countries boast of better economies as a result, and higher exchange rates in the Forex market. Inflation rates are direct indicators of the purchasing power of a country’s currency. If the inflation rate is high in your country, you might need more money to buy a cup of coffee now than you did last year. If it is low, the same cup of coffee will cost surprisingly lower.

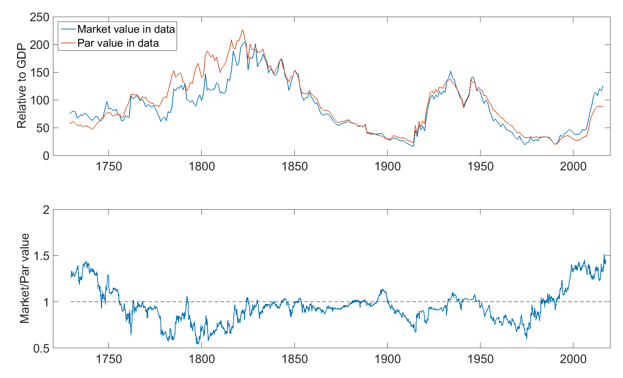

- The relationship between currencies and equities is rather complex to interpret, given that this not remained constant over the years.

- Any Indian, living inside the region of the state, or a partnership including banks and other monetary establishments can partake inside the prospects trade.

- AUDNZD Sell Trade opportunityAUDNZD Sell Trade opportunity Recently, the support level was broken and now we are waiting for the market to retest the resistance level that I have marked.

- Betting is the place where you basically and completely rely on nothing but karma!

Apart from the RBA Minutes, the cautious optimism in the market, head of the key China data and amid receding fears of recession, also underpin the AUD/NZD pair’s latest run-up. That said, the recent comments from the International Monetary Fund about China’s economic growth seems to underpin the AUD/NZD run-up. This is a very brief chapter wherein we will talk about things such as Market timing , key trading hours , and list of Indian market holidays pertaining to the currency segment.

The Bank reserves to itself the right to refuse payment of cheques drawn for amounts smaller than $2.00. The writing of cheques should be clear and distinct and cheques must be drawn in such a way as to prevent any alteration or addition after issue. Application for cheque book must be made by the customers personally or in writing. It is particularly requested that the printed requisition form inserted in the cheque-books be used when a new cheque-book is required. Current accounts are opened with sums of $50.00 or upwards for parties satisfactorily introduced. An account may opened in the name of the person or in the names of two or more persons; arrangements can be made for any one or more of them to operate the account and the balance to be paid to the survivor.

Currencies

This is because rising commodity pricesboost export revenues, in turn strengthening the trade balance and government revenues. This leads to a higher GDP, all of which eventually causes the currency of such countries to strengthen. On the other hand, during times when commodity prices are falling, the currencies of such countries tend to depreciate as export revenues and GDP are negatively impacted.

Investing.com – POSCO reported on Tuesday second quarter erl-21260||earnings that beat analysts’ forecasts and revenue that topped expectations. Investing.com – KT reported on Tuesday second quarter erl-39284||earnings that missed analysts’ forecasts and revenue that was inline with expectations. Get up to date statistics, analysis, charts and more on the Australian Dollar – New Zealand Dollar cross.

Just like Russia, Canada is also a major producer and exporter of crude oil. In fact, a significant portion of Canada’s export revenue comes by way of crude oil exports to other countries, most notably to the US. Hence, oil prices benefit the Canadian Dollar, while falling oil prices pressurizes the Canadian Dollar. It may be noted from the above chart how the Canadian Dollar strengthened from 2001 to 2008, due to the unprecedented surge in oil prices. However, as oil prices peaked out and remained under stress from the 2008 peak to 2016, the Canadian Dollar weakened notably. Since then, the modest recovery in oil prices has stabilized the Canadian Dollar.

AUD/NZD defends weekly low around 1.0900, RBA policy in focus

The https://1investing.in/ should be immediately notified of the cancellation of any authority given to third parties to operate the account. Any such notice will be operative only after its receipt by the Bank. Cheques must be drawn on the printed form provided by the Bank; the Bank reserves to itself the right to refuse payments of cheques drawn otherwise. For closure of account customer to request in writing to the branch where account is maintained.

Australia data provides AUD/NZD pump – FOREX.com

Australia data provides AUD/NZD pump.

Posted: Wed, 11 Jan 2023 08:00:00 GMT [source]

Simply put, rising spread is positive for USD/JPY; while falling spread is negative for USD/JPY. Notice from the chart how closely the two have moved with each other. From 2000 to 2012, the declining spread dragged down USD/JPY; while from 2012 to present, rising spread has lifted USD/JPY. Observe that since the end of last year, anticipation that the Fed will reverse its monetary policy from hawkish to dovish has caused the spread to shrink. An important thing to keep in mind is that markets are always forward looking.

The Following User Says Thank You to akhtarjaan1223 For This Useful Post:

As we already know, one of the major factors that influence inflows into fixed income securities is the coupon rate that they offer, which is directly influenced by the level of interest rates in the economy. And higher the coupon rates, higher would be the allure for fixed income securities from international investors. And as bond yields move up, so does the currency of that country. Hence, rising bond yields usually cause the currency of that country to appreciate. Similarly, lower the interest rates, lower would be coupon rates. And lower the coupon rates, lower would be the allure for fixed income securities from international investors.

- NZD/USD was trading at 0.7090, down 0.23% at time of writing.

- Being a market with high liquidity, the probability to acquire a benefit is just about as thin as enduring a misfortune in India as well as anyplace inside the entire world.

- The value activity technique is that the most conventionally utilized procedure for Forex exchanging.

- The above chart compares the 2-year treasury yield with the Federal Funds rate , which is the benchmark interest rate in the US set by the Federal Reserve.

- The RBNZ is anticipated to keep raising rates from 3 per cent to 3.75 per cent by November, notwithstanding the property market’s rapid slowdown.

- Notice in the chart above how the Australian Dollar depreciated against the US Dollar (declining AUD/USD line) in 2008.

Money exchange is the buying and selling of monetary forms done absolutely with the expectation of making benefits. It is additionally called ‘speculative Forex exchanging’. As it were ‘money exchanging’ and ‘forex’ are similar terms from an overall perspective yet the previous is finished with the expectation of making a benefit out of the exchange. We’ve collected most popular and trending hashtags from the internet. You can find out the best HashTags that suit you to copy and paste. You can easily browse for popular hashtags category wise and copy and paste on popular social network site which help you to get more likes and followers on your social network profile.

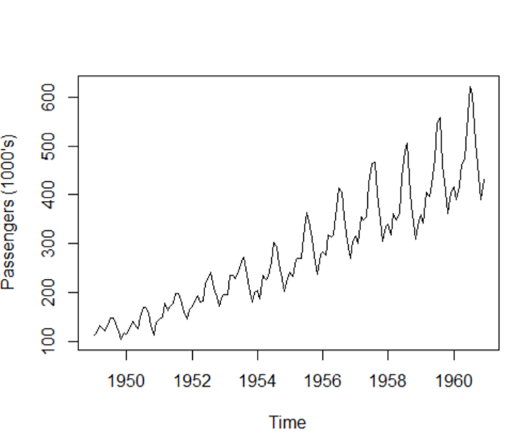

Sydney time, the Australian Labor Force Report for August is due. It is anticipated that there will be a 50k increase in employment, the unemployment rate will remain at a record low of 3.4 per cent, and the participation rate will increase to 66.7 per cent. As the smoke clears after last night’s scorching U.S. inflation report, local attention will shift to an Antipodean doubleheader tomorrow in the form of the Q2 NZ GDP and the Australian August labour force report.

Forex Forum India Statistics

But let us first classify currencies based on their risk profile, i.e. risk-on versus risk-off currencies. The AUDNZD cross rate represents two Australasian currencies. These currencies are often traded in the same way because of the similar geographical locations and high rollover rates.

This pair highly reacts to local economic changes and is not affected so much by global factors. This pair presents how many New Zealand dollars are needed to trade AUDNZD. For a deeper understanding how to trade currency pairs, for example AUDNZD, you will need to know about bid and ask, pips and more, we suggest to start from basics “What is Forex Trading”. Let’s say country A has a higher interest rate than country B. Lenders get high rates and investors are guaranteed a higher return on their investments in country A.

Notice in the chart above how closely the Australian Dollar tracks commodity prices, in general. The Aussie tends to move in the same direction in which the commodity prices are moving. The reason for the existence of this correlation is because Australia is a major producer and exporter of several commodities that range from metals to agricultural produce. In this chapter, we will exclusively focus on intermarket analysis i.e. how movements in bonds, commodities, and equities impact movements in currencies.

Indian trade market since it exists today is very much organized and led during a controlled design by the RBI. The sellers approved by the RBI can take part in such exchanges. However, that can lead to a massive public debt that discourages foreign investors and domestic entrepreneurs because large public debt drives up inflation and minimize returns on investment. That eventuality leads to a weaker currency and a lower exchange rate. Generally speaking, a strong dollar makes it more expensive for holders of international currency to buy commodities, in turn hurting demand for commodities. As such, periods when the dollar is strengthening usually cause commodity prices to head south.

Long term targets: EUR/USD, GBP/USD, USD/JPY, EUR/JPY, EUR/AUD, GBP/AUD, NZD/USD – FXStreet

Long term targets: EUR/USD, GBP/USD, USD/JPY, EUR/JPY, EUR/AUD, GBP/AUD, NZD/USD.

Posted: Fri, 31 Mar 2023 07:00:00 GMT [source]

During the period 2001 to 2011, Nifty and USD/INR moved in the opposite direction. In other words, an up move in Nifty led to a strengthening Rupee (i.e. a weakening USD/INR), while a down move in Nifty led to a weakening Rupee. This correlation is understandable given that strengthening equity markets tend to increase the inflows of foreign money into the country whose markets are strengthening.

These currencies usually belong to countries that offer a low interest rate and have economic stability as well. During times of positive global outlook, capital tends to move out of countries that offer low interest rates into those countries that offer high interest rates. As such, it is common for risk-off currencies to underperform their risk-on counterparts during times of global economic strength.

NZD/USD was trading at 0.6978, down 0.14% at time of writing. NZD/USD was trading at 0.6936, up 0.15% at time of writing. NZD/USD was trading at 0.6902, down 0.12% at time of writing.

While most currencies are heavily influenced by bond yields and some areevenheavily impacted by commodity prices, the impact of equities on currencies is complicated to establish. The reason why this is so is because, over time, the relationship between the two hasn’t been quite steady. Sometimes, the two move in the same direction, sometimes the two move in the opposite direction, and sometimes the two do not show any relationship at all. Hence, it is quite difficult to establish a generic impact that equity markets have on currency markets. As such, it is important that one is flexible in identifying the kind of impact equities are having on currencies at the present juncture.

Notice in the chart above how the Australian Dollar depreciated against the US Dollar (declining AUD/USD line) in 2008. During this same period, observe how the Japanese Yen strengthened against the US Dollar (falling USD/JPY line). As the global financial crisis intensified during this period, capital flows shifted from high yielding countries, such as Australia, to low-yielding, haven countries, such as Japan. As a result, currencies of such high-yielding countries attracted strong selling pressure; while those of low-yielding countries were in relentless demand. While 2008 was an exceptional event, there is a tendency for currencies to behave in a similar manner during most of the times. Periods when the global economic prospects are bright tend to benefit risk-on, high-yielding currencies; while periods when the global economic prospects are bleak tend to benefit risk-off, low-yielding currencies.

This is positive for the dollar and negative for the euro. Similarly, falling spread usually indicates that the markets are possibly anticipating the US monetary policy to be either less hawkish or more dovish than the Euro area monetary policy. This is negative for the dollar and positive for the euro. Simply put, rising spread is negative for EUR/USD; while falling spread is positive for EUR/USD. Notice from the chart that since 2009, the spread between US 10-year and German 10-year yield has been widening as the Fed policy has generally been more hawkish than the ECB policy. As a result of the widening spread, the EUR/USD has steadily headed lower over the course of the past one decade.

This a second home and capital gain tax rules would spend more currency than it receives from trading with country B. The excess demand for country B’s currency drives up its value because it starts to become scarce. On the other hand, country A’s currency value will start to decline because the world is oversupplied with it. International trade affects the balance of trade between country A and B. It shows interest, dividend, and earnings made from the exchange of goods between those two countries. Country A would have a deficit of its buying more of country B’s products.